Take note - This post is only applicable to users who have updated their Tax Year-end 2021/2022 instances to Release 5.8a, and employers who registered with SARS for employee's tax purposes on or before 25 June 2021.

Release 5.8a for Sage Business Cloud Payroll Professional was released on 11 March 2022 which includes the South African tax tables and rates for 2022-2023, and updated ETI tables.

We are aware the some users updated their payroll instances to Release 5.8a update while the companies were still in February 2022, before they started the new tax year in March 2022, which resulted in the Tax Year-instances to be on Release 5.8a.

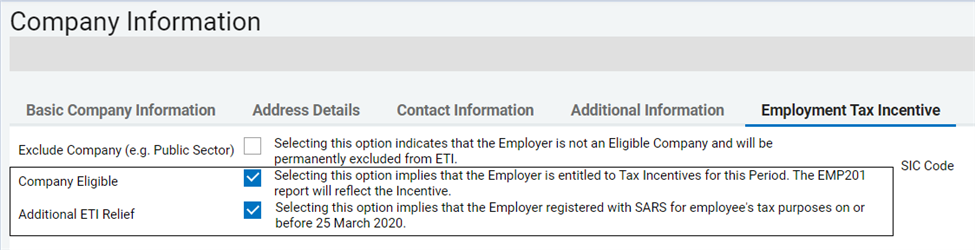

During the data conversion process to the new version, the "Additional ETI" tick on the Basic Company Information screen was deactivated. Refer to the Release Notes for more details.

How will this impact on my payroll application

- The deactivation will not change any ETI values or calculations in your application

- The deactivation however will impact on the ETI Validation utility, when you export and select to recalculate of ETI values - the recalculation in Excel will not include the Additional ETI tables.

- The ETI Validation utility is designed to apply the ETI tables based on the setup selections on the Basic Company Information screen during export of data, and will need to be reviewed and updated.

How will I resolve this issue?

- Access your Tax Year-end Copy System (on Release 5.8a in February 2022)

- Access your Basic Company Information screen

- Select the ETI tab

- Ensure that both boxes for Company Eligible and Additional ETI Relief is ticked (if applicable)

- Export the ETI values using the ETI Validation utility again (Main Menu > Utilities > ETI > ETI Validation > Step 2)

Related articles: