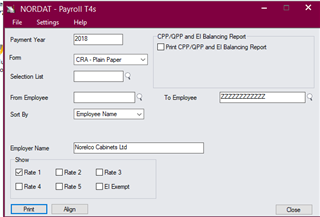

Was wondering if anyone else has run the PIER Report in Canadian Payroll for 2018 calendar year in Payroll 7.3 with the latest tax table?

A couple of users are reporting that the CPP columns that are showing a discrepancy are not taking the 3500 exemption into consideration.