separate GL account?

When a cost structure is assigned to a standard cost product, and a purchase receipt is created, the expectation is to have the amount of the cost structure posted to an overhead or landed cost GL account not the RNI account.

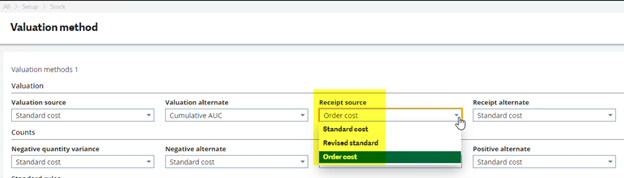

However, it all depends on how the valuation method is set up. In the Setup, Stock, Valuation method, when STD valuation is selected as the source valuation, the Receipt source has three options:

Standard cost;

Revised standard;

Order cost.

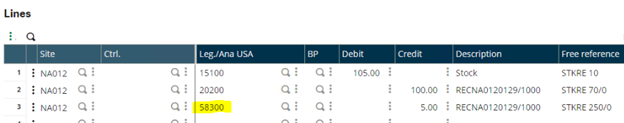

If the receipt source is set to standard cost instead of order cost, the cost of the product plus the landed cost will all be posted to the RNI account.

On the other hand, if the receipt source is set to order cost, posting a PO receipt with landed cost will result in posting the cost to a separate GL account such as an overhead account or something similar.