I bet you have spent the entire summer eagerly waiting for an update on the Sage X3 2023 1099s. The exciting 1099 news is here! Drum roll, please. There will be no changes to any of the X3 1099 forms this year! This means no new 1099 download for 2023! However, while X3 has no changes, see the New IRS rules on electronic filing section for a change that may apply to your company.

Here is a little 1099 review for everyone.

Sage X3 only supports the tracking of 1099-NEC (Nonemployee Compensation), 1099-MISC (Miscellaneous Income), 1099-DIV (Dividends and Distributions) and 1099-INT (Interest Income) and the printing of 1099-NEC and 1099-MISC plus the 1096 forms for NEC and MISC.

The 1099s totals for 2023 should only include payments made during the calendar year of 2023. The invoice date does not come into play when calculating 1099 amounts-only the payment date matters.

For tax information, refer to IRS.gov or to your company tax advisor.

If you didn’t install Sage X3 2022 1099s before

If you did not download and install the 2022 1099 patch previously click Download Sage X3 Version 12.0 1099 2022 to obtain the patch, release notes and installation guide. The 1099 2022 update was only for 2019 R5 (v12.0.20) and above. This 2022 1099 update was included in 2023 R1 (v12.0.33). Refer to the installation documentation for additional instructions.

If you are on v6, v7. U9, v11, or v12.patch levels 19 and lower, please see your Sage certified business partner for assistance in extracting this data.

Printing forms 1099-NEC, 1099-MISC and 1096

Depending on your printer and drivers, you may have to adjust your 1099 crystal report. See your company crystal expert or your business partner for assistance.

To purchase forms, call Sage Checks and Forms at 800-617-3224 or go to https://www.sagechecks.com/estore/ and ask for the generic preprinted 1099-MISC or 1099-NEC/ 3 per page forms.

If using a local forms provider, please be sure to order forms with the “DETACH BEFORE MAILING” message or widest margin on the left.

New IRS rules on electronic filing

The IRS has developed IRIS (Information Reporting Intake System), an online portal that allows taxpayers to electronically file (e-file) information returns after December 31, 2022, for 2022 and later tax years. See part F of General Instructions for Certain Information Returns or go to IRS.gov/IRIS for additional information and updates.

The Taxpayer First Act of 2019, enacted July 1, 2019, authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250-return requirement for 2023 tax returns. However, the e-file threshold for returns required to be filed in 2023 remains at 250. The e-file threshold of 10 is effective for returns required to be filed on or after January 1, 2024.

How can you extract this data?

This new rule will require companies with over 10 returns to use the IRIS electronic filing system. The upload requires a simple .csv file which can be exported from the existing 1099 summary.. Note this is only for the extraction of data. This is not a format for a direct upload.

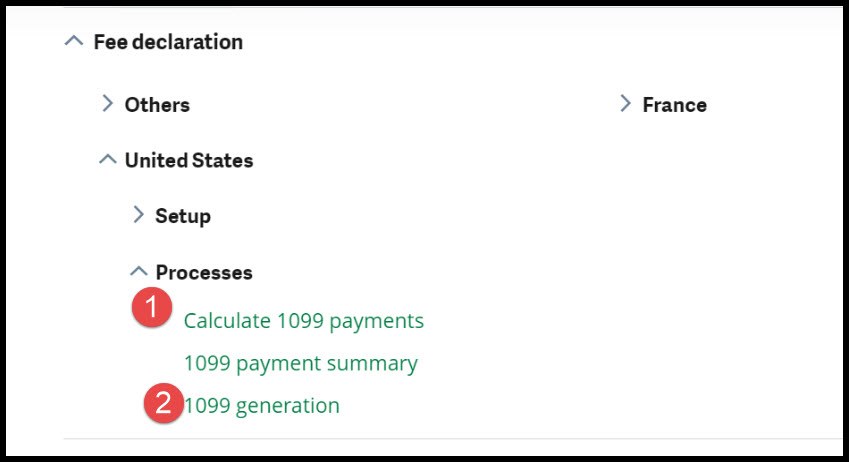

Calculate 1099 payments and run 1099 generation for 2023.

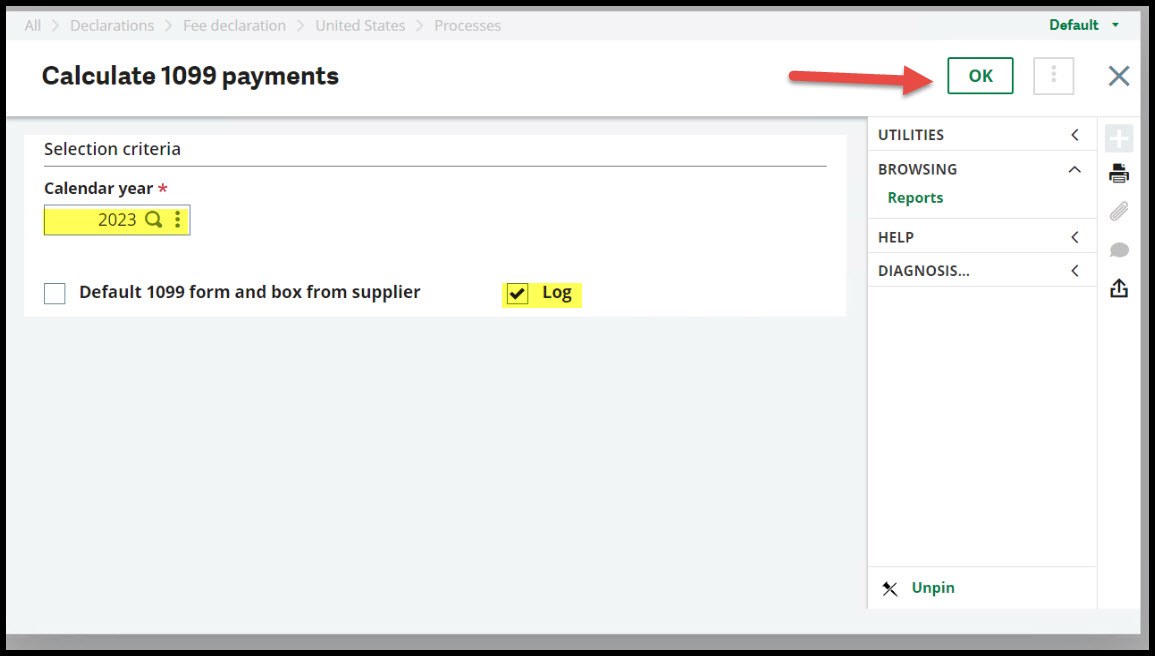

For the Calculate 1099 payment, fill in the Calendar year and select Log. I always recommend choosing to generate a log when the option is available. Logs provide useful inform concerning what was processed and errors.

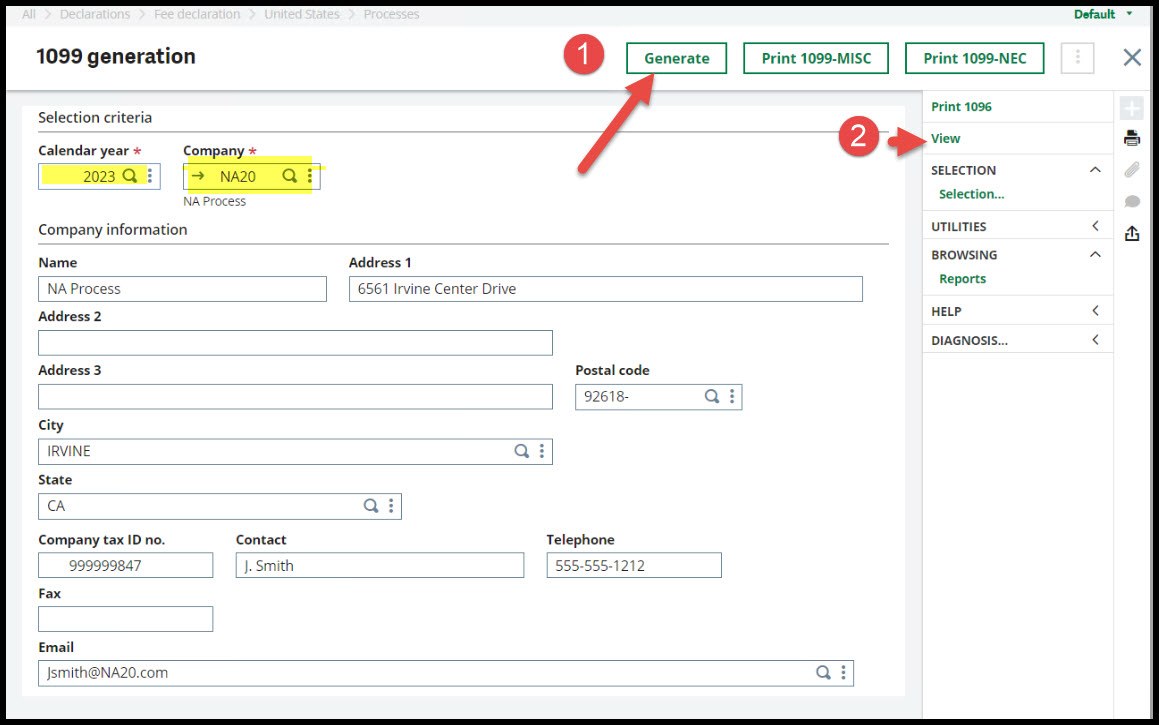

For 1099 generation, be sure to select the Calendar year and Company code before clicking Generate. Remember that 1099s can only be run by company.

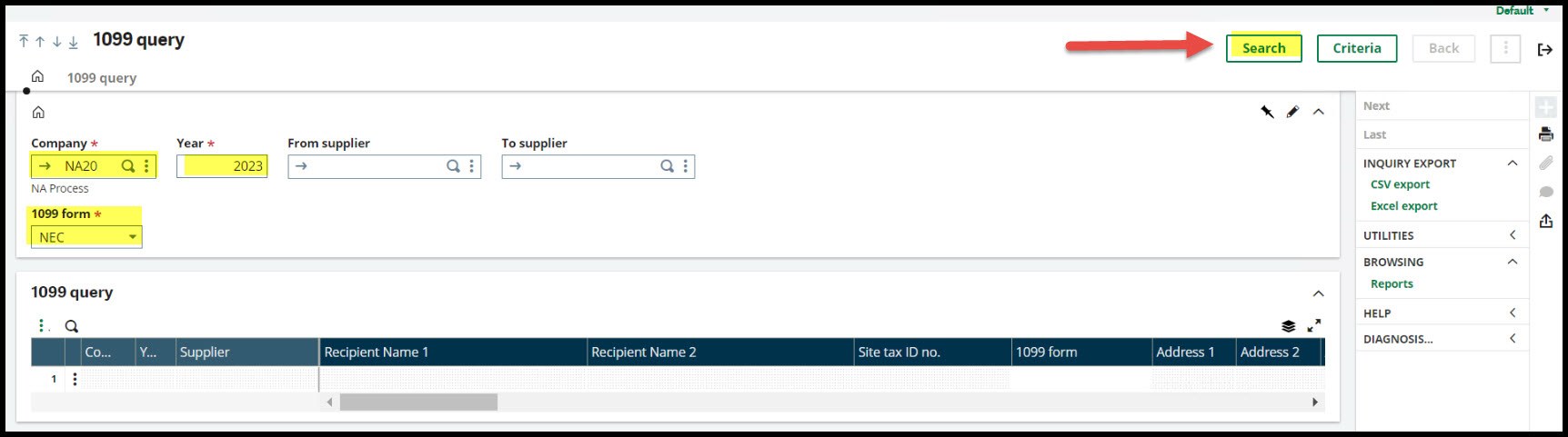

Once the 1099 generation has finished running, select View from the right column. This will bring up the 1099 query screen. Complete the Company, Year and 1099 form fields. Then select Search.

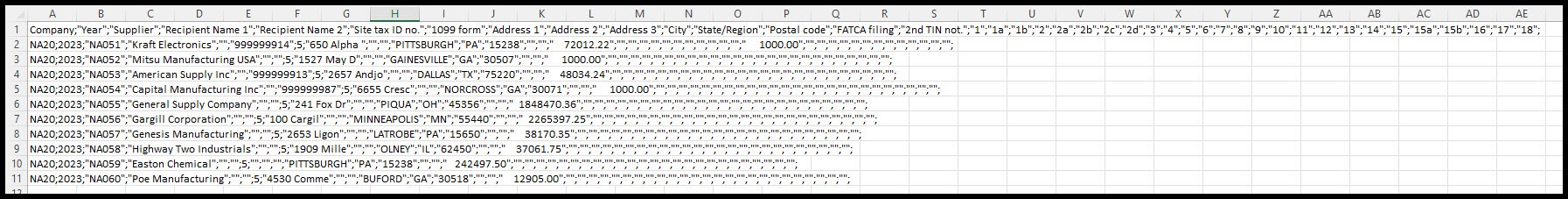

I have selected Company NA20, Year 2023 and 1099 form NEC for this example. You can only run one form type and one company at a time.

You can scroll the query results to do a final review.

When you have finished your review, click CSV export in the right box and start the export process.

The export file will be saved to your download directory. I have opened the CSV file in Excel for display purposes. If you need assistance with the IRS electronic filing process, please see your business partner.

I hope you found this 1099 news to be an exciting addition to your summer fun.

Take care my X3 friends. Stay safe!